Table of Contents

- Where does tariff money go? A look at where the revenue lands

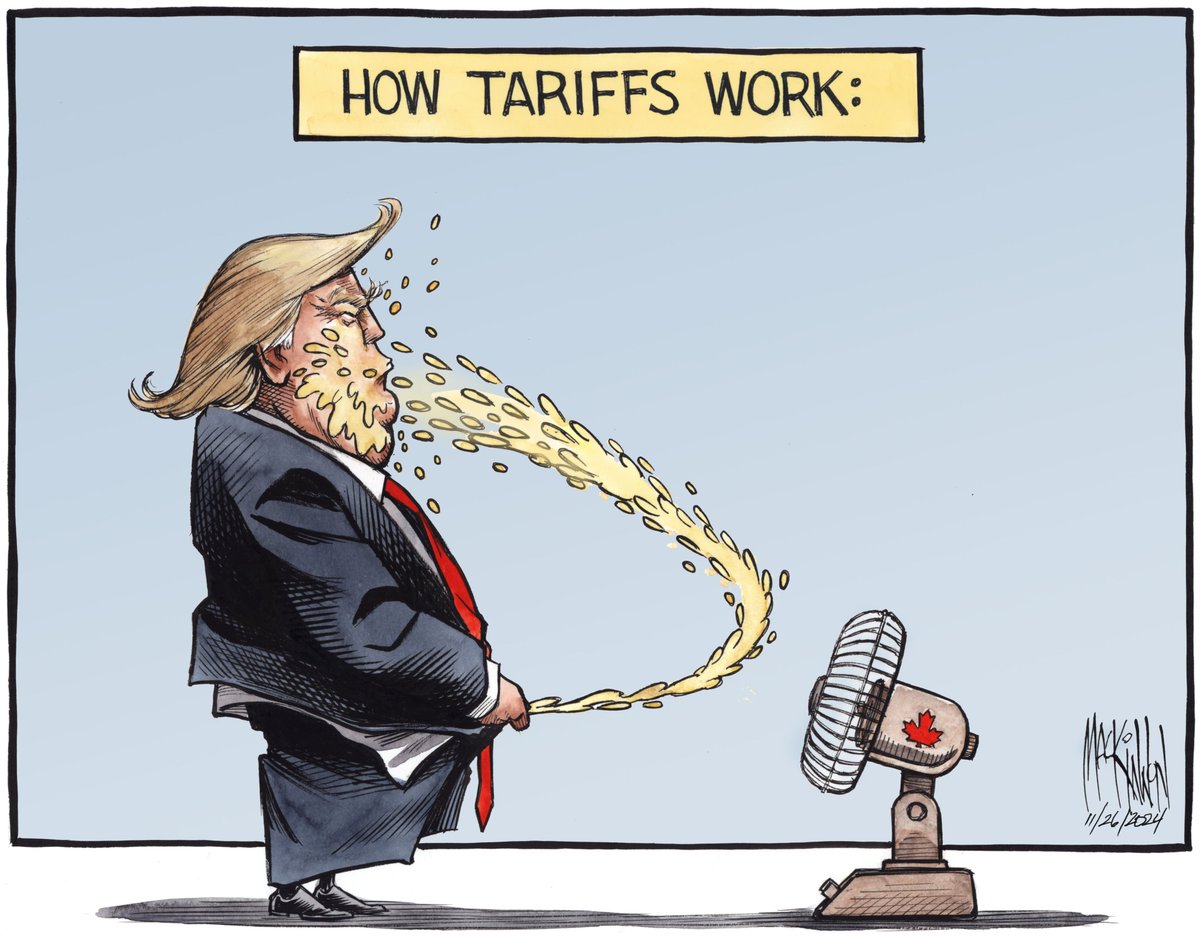

- TASTE THE GOLDEN SPRAY (or: How tariffs REALLY work) - The Adventures ...

- US-China Tariff War and Apparel Sourcing: A Four-Year Review (updated ...

- What Is A Tariff And Why Are They Important?, 53% OFF

- Why It's Crucial to Read Your Tariff - Tariffs Reveal Additional Fees

- Tariffs Cartoons, Illustrations & Vector Stock Images - 2233 Pictures ...

- Trump's New Tariffs on Canada, Mexico, and China: Is India Next?

- The effects of tariff rates on the U.S. economy: what the Producer ...

- What Is Tariff In Electrical, Characteristics, Types Of Tariff, Benefits

- Trump’s Proposed 25% Tariff on Canada and Mexico: Potential Impacts on ...

Tariffs have been a crucial aspect of international trade for centuries, playing a significant role in shaping the global economy. Despite their importance, many individuals and businesses are unclear about what tariffs are and how they work. In this article, we will delve into the world of tariffs, exploring their definition, types, and functionality, with insights from Avalara, a leading provider of tax compliance solutions.

What are Tariffs?

A tariff is a tax imposed by a government on imported goods and services. The primary purpose of tariffs is to protect domestic industries, regulate international trade, and generate revenue for the government. Tariffs can be levied on a wide range of products, from raw materials to finished goods, and can vary depending on the country of origin, type of product, and other factors.

Types of Tariffs

There are several types of tariffs, including:

- Ad Valorem Tariffs: These tariffs are levied as a percentage of the value of the imported goods.

- Specific Tariffs: These tariffs are levied as a fixed amount per unit of the imported goods.

- Compound Tariffs: These tariffs combine ad valorem and specific tariffs, with a percentage of the value and a fixed amount per unit.

- Tariff-Rate Quotas: These tariffs impose a lower tariff rate on a limited quantity of imported goods, with a higher rate applied to quantities exceeding the quota.

How Do Tariffs Work?

The process of imposing tariffs involves several steps:

- Country of Origin: The country of origin of the imported goods is determined to identify the applicable tariff rate.

- Tariff Classification: The imported goods are classified according to the Harmonized System (HS) code, which determines the applicable tariff rate.

- Tariff Calculation: The tariff amount is calculated based on the type of tariff and the value or quantity of the imported goods.

- Paying the Tariff: The importer pays the calculated tariff amount to the government, usually through a customs broker or freight forwarder.

:max_bytes(150000):strip_icc()/environmental-tariff.asp_Final-db183fa4034042e48aed19677831f430.png)

Impact of Tariffs on Businesses

Tariffs can have a significant impact on businesses, both positively and negatively. On the one hand, tariffs can protect domestic industries by making imported goods more expensive, thereby giving local businesses a competitive advantage. On the other hand, tariffs can increase the cost of imported raw materials, leading to higher production costs and reduced profitability for businesses that rely on imported goods.

Avalara's solutions can help businesses navigate the complex world of tariffs, ensuring compliance with regulations and minimizing the impact of tariffs on their operations. With Avalara's expertise, businesses can better understand the tariffs applicable to their products, calculate the correct tariff amounts, and avoid costly penalties and fines.

In conclusion, tariffs are a crucial aspect of international trade, playing a significant role in shaping the global economy. Understanding what tariffs are and how they work is essential for businesses that import or export goods. By recognizing the different types of tariffs and how they are imposed, businesses can better navigate the complex world of international trade and ensure compliance with regulations. With the help of Avalara, businesses can stay ahead of the curve and minimize the impact of tariffs on their operations.

For more information on tariffs and how they affect your business, visit Avalara today.